Governor Brian Kemp has recently signed two new bills concerning taxation in Georgia. The bills are focused on reducing the rate of taxes and providing tax credits. These new bills come after the close of the legislative session.

The first bill is House bill (HB) 111. This bill relates to the imposition, rate, computation, exemptions, and credits relative to income taxes. Specifically, HB 111 reduces the tax rate.

The second bill is HB 112. This bill relates to income taxes and provides taxpayers a tax credit.

Specifically, HB 112 grants a one-time tax credit for individual taxpayers who filed income tax returns for the 2023 and 2024 taxable years

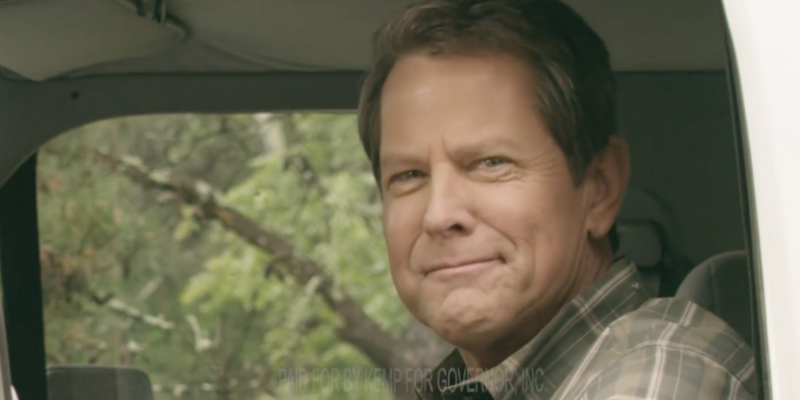

When Governor Kemp discussed these bills, he framed them as his way of keeping promises.

Kemp commented on X, “It’s fitting that today is the day I signed HB 111 & 112 into law, delivering on our promises to provide more tax relief to hardworking Georgians! As taxpayers file their returns, they can look forward to another special tax refund this year and an even lower state income tax rate for tax year 2025.”

Lieutenant Governor Burt Jones also commented on these bills. He stated that putting money back in Georgian’s pockets has always been a priority.

Jones commented on X, “With (Governor Kemp’s) leadership, Georgia continues to serve as an example for the rest of the nation on how to reduce taxes and give more than a billion dollars back to our citizens, while having a healthy reserve and fiscally sound budget.”

Jones continued to discuss how these bills lead the way to implementing his tax agenda. Jones stated, “These bills becoming law today bring us one step closer to eliminating the state income tax, a priority I have always been a proponent of.”

Jones concluded by noting how this agenda strikes the balance between economic prosperity and financial liberty.